7 Hard Truths from Grant Cardone

Who is Grant Cardone?

Grant Cardone is an American businessman, real estate mogul, and best-selling author of books like The 10X Rule. He is the CEO of Cardone Capital, a firm that manages over $4 billion in real estate assets. While he is now a prominent financial influencer and mentor, Cardone often shares that his journey began in a much darker place—struggling with drug addiction and debt in his early 20s. After turning his life around at age 25, he built a business empire centered on sales training and multi-family real estate, eventually becoming one of the most recognized voices in modern entrepreneurship.

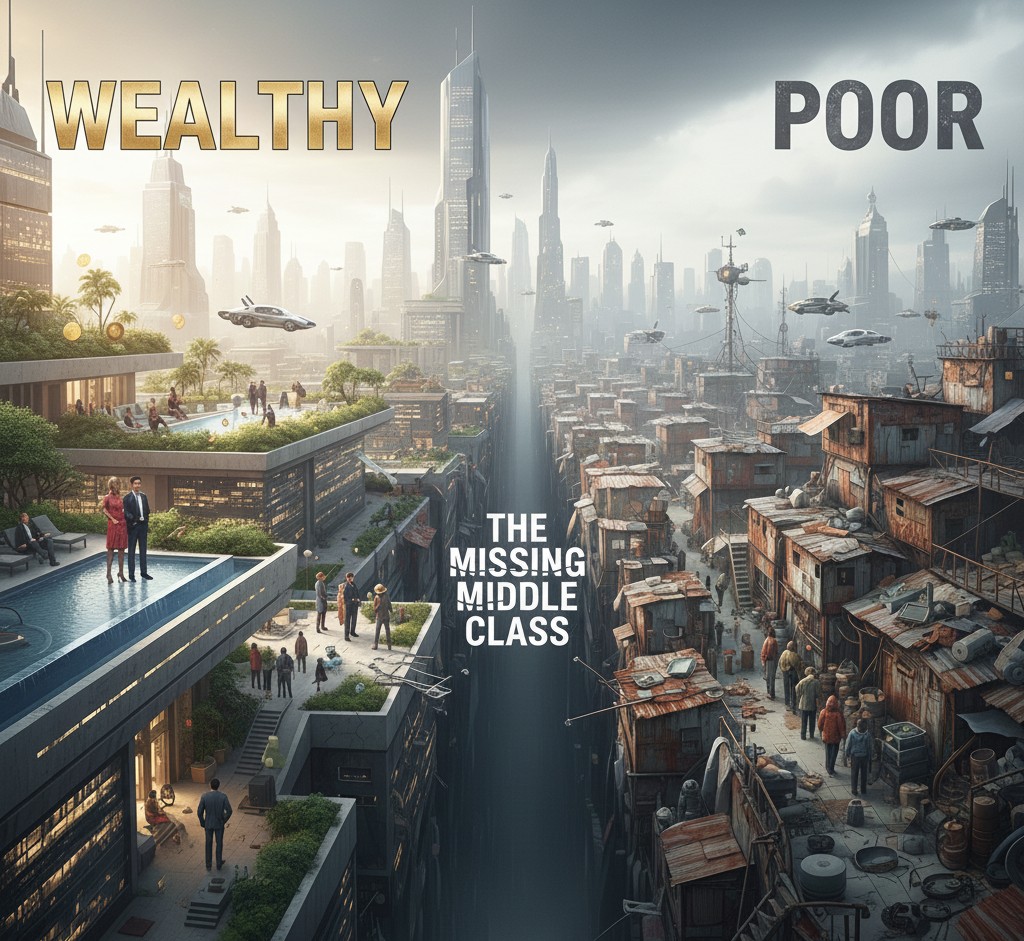

In a recent message to his followers, Cardone dropped a bombshell: the “Middle Class” no longer exists. According to him, you are either Wealthy (possessing freedom and legacy), Rich (having money but remaining one crisis away from broke), or Poor (being left behind).

Even if you are currently earning a six or seven-figure income, Cardone argues you might still be “poor” if you fall into these seven traps. Here are the warning signs he says you need to watch out for:

1. Breaking the 3X Rule

If you aren’t earning at least three times your monthly expenses, you are effectively living paycheck to paycheck. Without this buffer, a single medical bill or job loss can wipe out your progress, leaving you fighting just to stay afloat.

2. The Plastic Trap

Relying on credit cards to survive is a “financial grave.” When interest stacks up and debt snowballs, you stop owning your future and start renting it from the bank.

3. Passive Surrender

Wealth doesn’t come to those who wait. If you find yourself saying “I wish” instead of “I will,” Cardone argues you’ve handed control of your future over to your boss or the economy. Wealth only comes to those who act.

4. Single-Income Dependence

Relying on one source of money is a gamble. If you lose that one job, you lose everything. Furthermore, a single income usually comes with a “ceiling” that prevents true financial expansion.

5. No 90-Day Safety Net

If you couldn’t last 90 days without your primary income, you are walking a tightrope without a net. Wealthy people play both offense and defense; without a cushion, one market downturn could mean bankruptcy.

6. Middle-Class “Comfort” Deception

Comfort is the ultimate trap. Feeling “safe” because you can cover your bills and take a yearly vacation is an illusion. True financial health isn’t about being comfortable; it’s about being secure enough to survive an emergency or a market crash.

7. The College Lie

Believing a degree guarantees wealth is a setup. Many people go over $100,000 into debt for a “safe” career, only to end up overworked and underpaid. Cardone insists that real wealth is created through skills, action, and ownership, not a diploma.

The 10X Shift

Cardone’s message is clear: if three or more of these signs apply to you, it’s time to change your strategy. He often reflects on his own experience—being 30 years old and buried in $30,000 of debt—to show that a turnaround is possible with the right wealth plan and a “10X” mindset.

The Gift of Financial Freedom

If these 7 signs hit close to home, don’t be discouraged—be motivated. The first step to wealth is awareness; the second is action.

As we celebrate Christmas tomorrow, I want to wish you a season of abundance. May your home be filled with peace and your future be filled with 10X opportunities.

Merry Christmas!