When you earn income, you can place your money into one of three types of accounts: taxable, tax-deferred, or tax-free. Let’s take a closer look at how each of these options impacts your returns over time.

Taxable Accounts

A taxable account, like a checking or savings account, is taxed twice. First, your income is taxed before it even enters the account. Then, the gains—typically less than a percent annually—are taxed again. With such low interest rates, taxable accounts tend to be more suitable for day-to-day expenses or short-term savings rather than long-term wealth-building.

Tax-Deferred Accounts

In a tax-deferred account, such as a traditional IRA or 401(k), your contributions grow tax-free until you withdraw the money in the future. You’ll pay taxes when you take distributions, usually during retirement. If you expect to be in a lower tax bracket in the future, this can be a smart place to invest. And remember—take full advantage of any employer matching contributions. After the match, it might be wise to consider other investment options, depending on your tax situation and financial goals.

Tax-Free Accounts

Tax-free accounts, such as a Roth IRA, whole life policy, or indexed universal life (IUL) policy, allow you to contribute after-tax dollars, but the gains you accumulate over time are never taxed again. This is a big win when it’s time to withdraw your funds. Additionally, distributions from these accounts do not affect the level of your Social Security benefits. Tax-free accounts are a solid option for tax diversification and can serve as a hedge against potential future tax increases.

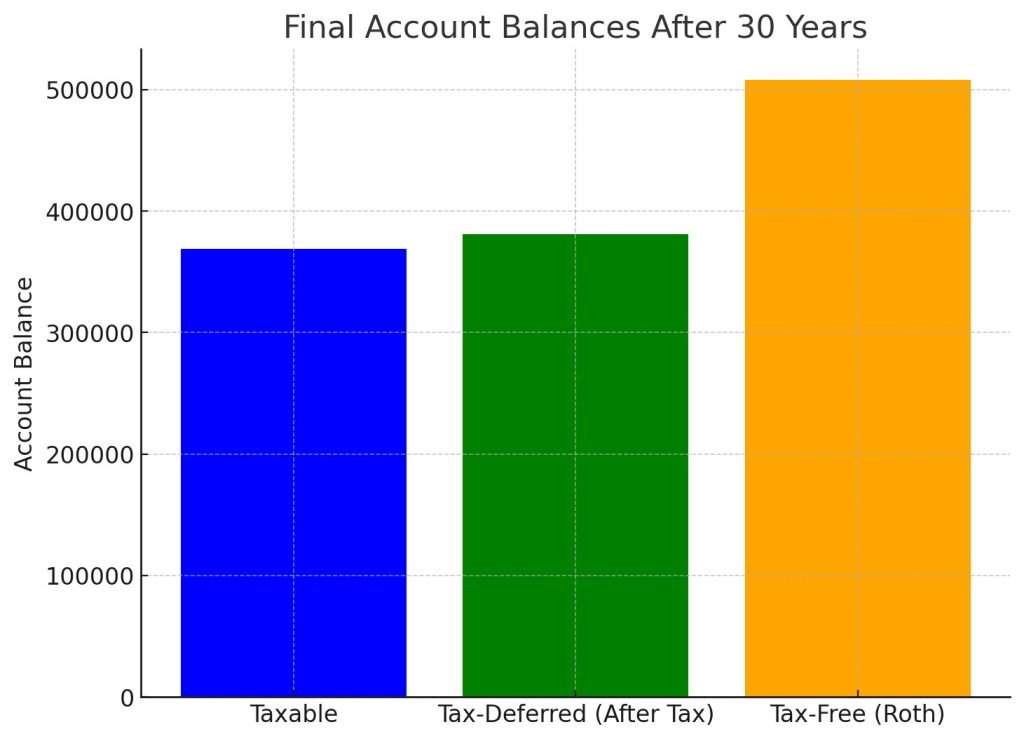

Graphical Comparison of Account Growth Over Time

Assumptions Behind the Graph:

- Initial Investment: A starting investment of $10,000 for each account.

- Annual Contribution: An additional $5,000 contributed each year.

- Annual Return: A consistent 7% annual return was assumed across all accounts.

- Tax Rate: A 25% flat tax rate applied to both taxable gains and tax-deferred withdrawals.

- Taxable Account: Gains were taxed yearly at 25%, reducing reinvestment.

- Tax-Deferred Account: No taxes on growth until withdrawal, at which point 25% taxes were applied.

- Tax-Free Account: Contributions were made post-tax, but no taxes were applied on growth or withdrawal.

- Time Horizon: The investment period spans 30 years.

Whether you’re aiming to maximize contributions, grow your wealth, or ensure a tax-efficient distribution strategy, understanding these account types is crucial for your financial success. Curious about which account type is best for your financial goals? Let’s schedule a quick consultation to review your options and create a strategy that works for you.