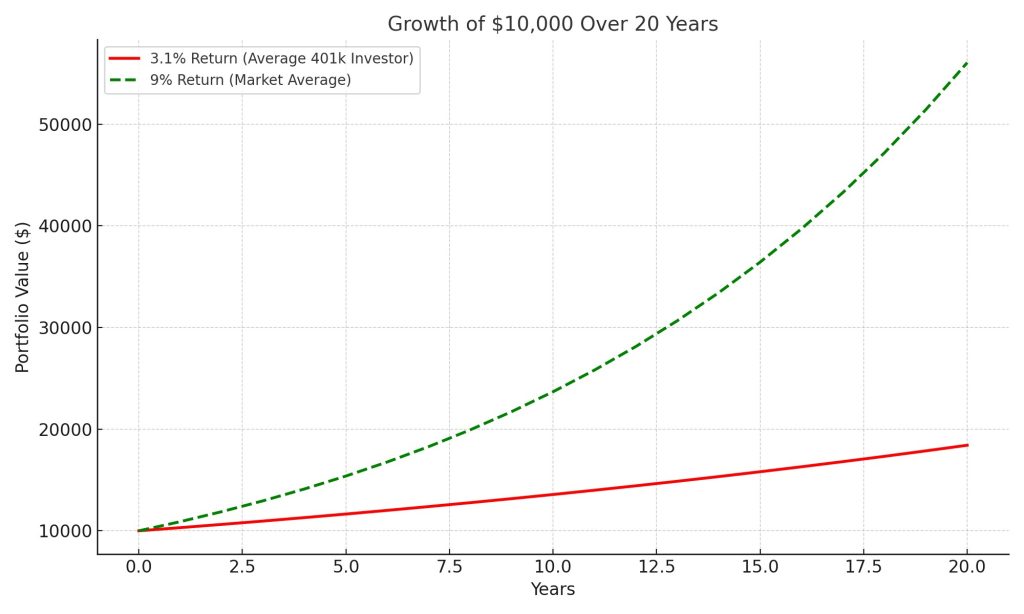

The latest How America Saves report from Vanguard dropped a quiet bombshell: over the last 20 years, the average 401(k) investor has earned just 3.1% annually. That’s not a typo—and it’s not the market’s fault. The S&P 500 returned over 9% annually in the same period. So where’s the disconnect?

Let’s break it down.

1. It’s Not the Market—It’s the Behavior

Vanguard’s data shows that the 3.1% average isn’t due to a lack of opportunity, but a lack of discipline. Most 401(k) underperformance is behavioral:

- Buying high and selling low (panic selling during downturns, chasing hot funds during booms)

- Frequent allocation changes (market timing disguised as “strategy”)

- Loans and withdrawals (sabotaging long-term growth for short-term needs)

Even those who were consistently invested often leaned toward overly conservative allocations, especially among younger workers. And guess what? Playing it too safe can be just as risky.

2. Fees Still Matter

While 401(k) plans have come a long way in reducing costs, many participants still end up in higher-fee funds or managed accounts that quietly erode returns. Even a 1% fee can devour tens of thousands of dollars over a 30-year career.

3. Time in the Market Beats Timing the Market

Investors who stuck to a disciplined, diversified portfolio over the last two decades likely saw returns much closer to 6–8%, depending on allocation. But average investor behavior diluted that down to 3.1%.

Why? Because emotions make terrible investment advisors. Fear and greed drive poor decisions that cost more than any bear market.

4. So What Should You Do?

If your 401(k) growth feels sluggish, now’s the time to course-correct:

- Stick to a plan. A well-diversified portfolio aligned with your time horizon will outperform short-term tinkering.

- Automate your contributions. Set it and forget it—consistency builds wealth.

- Don’t borrow from tomorrow. Avoid 401(k) loans and hardship withdrawals unless absolutely necessary.

- Review, but don’t overreact. An annual check-up is good. Weekly tweaks? Not so much.

Bottom Line: You Can Beat the Average

Vanguard’s 3.1% statistic is sobering—but it’s also avoidable. With the right habits, the right guidance, and a long-term mindset, you don’t have to be average. The greatest threat to your 401(k) isn’t the market. It’s you.