Estate Planning: Why Today Matters

Life gets busy, and it’s easy to convince yourself that estate planning is something you’ll get to “later”—maybe when you’re older, when you have more assets, or when things feel more settled.

The truth is simple: there is no perfect time to start estate planning, but there are countless reasons why today is better than tomorrow.

Estate Planning Isn’t Just for the Wealthy

One of the biggest misconceptions is that estate planning is only necessary for people with significant wealth. In reality, if you have anyone or anything you care about, you need an estate plan. It’s not about how much you have—it’s about protecting what matters most and ensuring your wishes are honored.

Without proper planning, state laws will determine what happens to your assets, who cares for your children, and who makes critical decisions on your behalf if you’re unable to do so. These decisions would be left to chance or made by a court system that doesn’t know you or your family.

There are life insurance providers even include complimentary estate planning services (valued at $800+) with their policies.

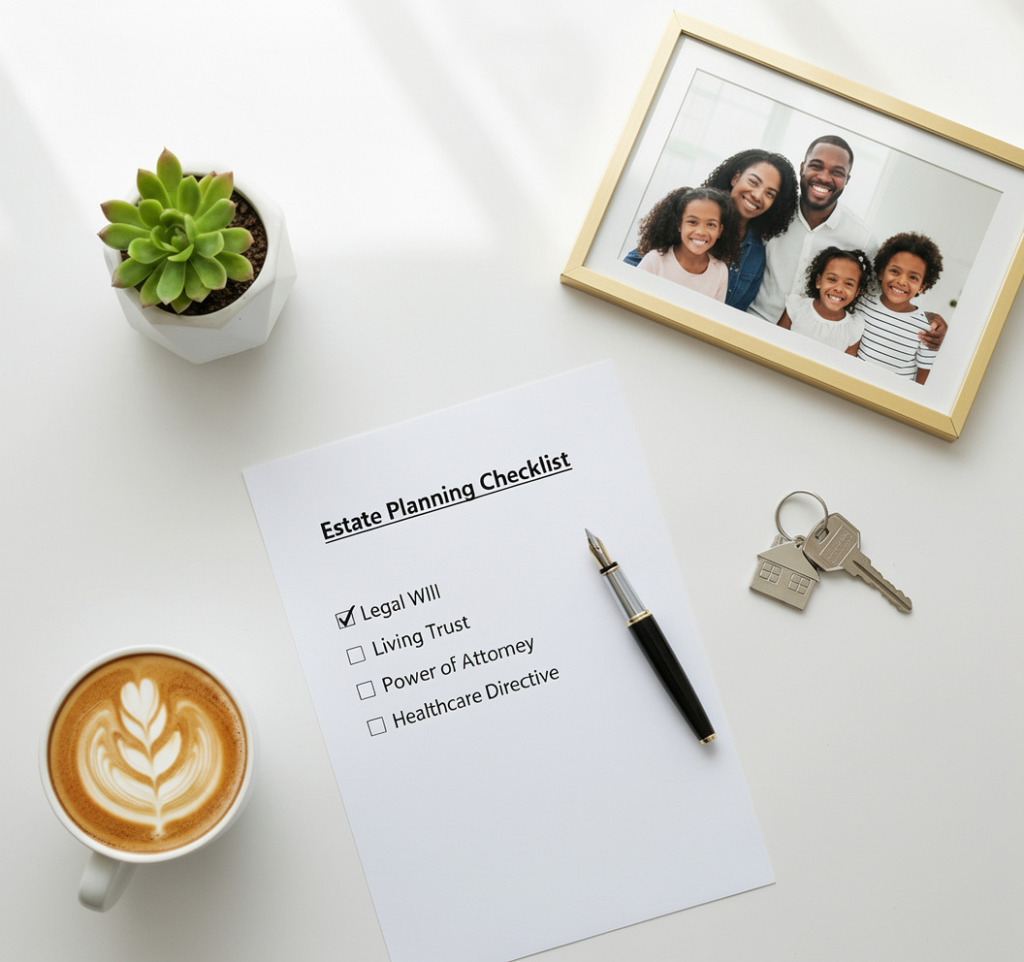

The Essential Documents Every Adult Needs

A comprehensive estate plan includes several key documents:

Legal Will – Determines how assets are distributed, designates guardians for dependents, and appoints someone to manage your wishes. Without one, your estate could be tied up in probate for months or even years.

Power of Attorney – Hands temporary financial decision-making authority to someone you trust if you become incapacitated, preventing families from struggling to pay bills or access accounts during a crisis.

Living Trust – Distributes money over time and allocates funds to specific needs like education or housing, offering flexibility that a will alone cannot provide.

Healthcare Directive – Specifies what medical actions should be taken if you can no longer make decisions due to illness or incapacity.

Medical Consent – Provides instructions to caregivers for a dependent’s medical emergencies.

Who Needs Estate Planning Right Now?

If you’ve reached any significant life milestone, you likely need estate planning services:

Parents need to determine who will care for their children if the unthinkable happens. Without clear legal documentation, this decision could end up in court.

Homeowners should have a plan for how the mortgage will be financed should one owner pass away unexpectedly.

Student loan holders can use a trust to reserve assets for loved ones rather than seeing them consumed by debt obligations.

Newlyweds and unmarried partners need protection, especially since unmarried partners often have no inheritance rights under state law, regardless of relationship length or commitment.

Making It Accessible

Estate planning tools have become increasingly accessible and user-friendly. What once required multiple expensive attorney visits can now be completed in minutes through guided digital processes. Many life insurance providers even include complimentary estate planning tools as part of their policy benefits—tools that would typically cost hundreds or even thousands of dollars if purchased separately.

The key is to start. Even basic estate planning is infinitely better than none at all.

The Cost of Waiting

Too many families wish they had acted sooner. Adult children struggle to interpret wishes, siblings argue over assets, and life partners are left in legal limbo—all because someone kept putting off these crucial conversations and decisions.

Estate planning isn’t about being morbid or pessimistic. It’s about being responsible and loving. It’s about giving your family the gift of clarity and financial security during the most difficult times they’ll ever face.

If you’ve been putting off creating your will, establishing a trust, or completing other estate planning documents, make this the year you finally take action. Your future self—and your loved ones—will thank you for it. Taking that first step today can provide peace of mind and protection for everything you’ve worked so hard to build.