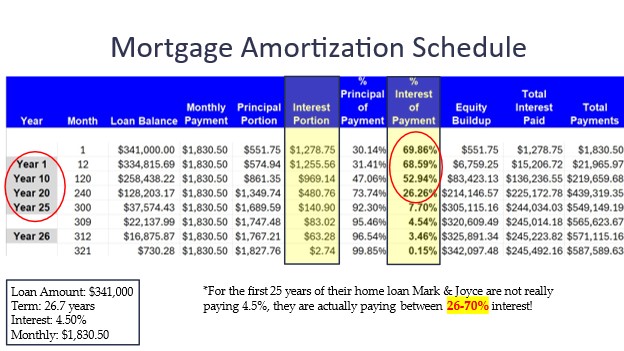

Imagine walking into your bank to apply for a mortgage. You carefully fill out the application, submit your ID, and then wait while the loan officer types away, maybe makes a call or two. Finally, the good news arrives: you’re approved! You sign the documents, proud of locking in that sweet 4.5% interest rate. But hold on—are you really paying just 4.5%? Let’s take a closer look.

Here’s the thing: mortgage interest is front-loaded. That means for much of your loan’s term, you’re primarily paying off the interest, not the principal. How much of the term, you ask? A good chunk of it.

Take Mark and Joyce, for example. On their $341,000 mortgage, spread over 26.7 years, they ended up paying between 26% to 70% of their payments toward interest—not the 4.5% they thought they were getting.

So, what’s the solution? Consider a strategy to eliminate your mortgage in 10 years or less. This could save you thousands of dollars in interest. Imagine applying the same approach to credit cards, student loans, or other debts. It’s no wonder consumer debt in America has ballooned to over $17 trillion.

Don’t let the bank keep more of your money than necessary. Contact us today for a free consultation on creating your personalized debt-elimination plan and take control of your financial future.